Ever watched $$$ worth of perfectly good cards turn into expensive toilet paper because you got greedy and hit them too fast? Yeah, me too. Most carders have two major problems that keep fucking them in the ass: either their cards decline from the jump, or they hit once and die immediately after.

Today we're diving deep into why your cards keep turning into single-use disposables and how to actually squeeze multiple transactions out of them without setting off every fraud system from here to Mumbai.

On Card Declines

I already covered this extensively in “Why The Cards You Bought Never Work,” so I’ll keep this brief. Your cards aren’t declining because of superstition. They’re declining because they’re dirty and bound checked.

Every card floating around the usual markets has been resold, bind-checked, and fingered by multiple payment processors. That's why I built the resell checker on BinX.cc:

Just throw in any card you're thinking about buying, and it'll tell you if that same card is being sold on other shops.

Your only real options here are finding vendors who actually give a shit about quality control or getting off your ass and sourcing your own cards. Everything else is just expensive wishful thinking. Which leads us on to the next big problem:

Single-Use Card Syndrome

Picture this: You just successfully carded a $300 jacket from some Shopify store. Card went through smooth as butter, no 3DS, order confirmed. You're feeling like a goddamn genius. So naturally, you load up another site, punch in the same card details, and... BOOM. Either you get a 3DS challenge or the card straight-up tells you to go fuck yourself.

But wait, it gets worse. That failed second transaction doesn't just ruin your current plans - it retroactively fucks your first order too. Suddenly your "clean" first transaction gets flagged because the second one made you look suspicious as hell. Now you've got two failed orders and a burned card. Congratulations, you played yourself.

Velocity: The Silent Card Killer

Here's where most newbies fuck themselves sideways. Normal people don't drop $500 at three different online stores within 20 minutes. They shop, think about it, maybe come back tomorrow, check their bank balance, ask their spouse - you know, human shit.

But us? We're trying to milk every drop out of these cards before they die. So we hammer transaction after transaction, thinking we're maximizing profit. In reality, we're basically walking into a bank with a ski mask on and wondering why security's giving us funny looks.

The faster you move, the more patterns you create. And modern fraud systems aren't looking for individual red flags anymore - they're looking for behavioral patterns that says "this motherfucker is up to no good."

The Processor Rotation Method

The solution isn't to card slower (though that helps). It's to card smarter. Think of payment processors like nightclub bouncers - if the same sketchy dude keeps showing up at different doors all night, they're gonna notice. But if you space it out, hit different venues on different nights, suddenly you're just another face in the crowd.

Processors AND Antifraud

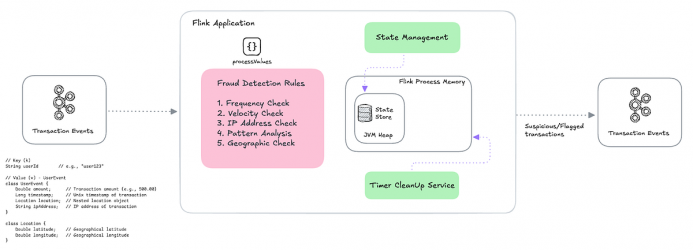

Before you even think about hitting a site, you need to do your fucking homework. You need to know their entire fraud prevention stack - both the processor AND the antifraud system.

Whether it's Stripe powering that Shopify store, Adyen handling your favorite airline, or Braintree processing that subscription service, you need to map this shit out. But processors are only half the equation. The antifraud systems - that's the other half that most carders ignore.

Here's what most idiots don't understand: Two shops might use completely different processors - one on Stripe, one on Adyen - but if they're both protected by Riskified, you're hitting the same AI brain. That second transaction is gonna get flagged faster than a Confederate flag at a diversity seminar.

These antifraud systems - Riskified, Forter, Signifyd, Sift, Kount - they're all watching your every move, building behavioral profiles, and sharing data across their networks. Fashion retailers love Riskified, enterprise shops swear by Forter, and high-ticket merchants hide behind Signifyd's chargeback guarantees.

The point is this: A Shopify store running Stripe + Riskified is fundamentally the same as a custom site running Adyen + Riskified when it comes to fraud detection. The processor handles the money movement, but the AI making the allow/deny decision is the same fucking brain.

So when you're mapping out targets, don't just note "oh this uses Stripe" or "that's on Square." Dig deeper. Check their antifraud setup. Find out if they're using third-party protection or relying on the processor's basic filters. This intel is what separates amateur hour from professional operations.

The Rotation Strategy

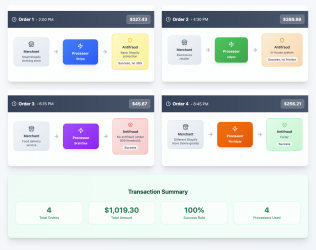

Here's where shit gets tactical. Never hit the same processor OR antifraud system back-to-back with the same card. Let me show you exactly how this works with a real example.

Card: Fresh Visa from Texas

Goal: Extract maximum value without burning it

Order 1 (2:00 PM):

Order 2 (4:30 PM):

- Electronics retailer

- Adyen + In-house system

- $389.99

- Success, no friction

Order 3 (6:15 PM):

- Food delivery service

- Braintree + No antifraud (under their $50 threshold)

- $45.67

- Success

Order 4 (8:45 PM):

- Different store (home goods)

- WorldPay + Forter (different antifraud than Order 1)

- $256.21

- Success

Total extracted: $1019.30 from a card that would've died after the first transaction if you'd been impatient and used it on another site with the same stack.

Notice the pattern? Different processors, different antifraud systems, different merchant types, varied transaction amounts, natural time gaps. Here's the beautiful part - these systems operate in completely isolated silos. Stripe's AI has no fucking clue what Adyen's system flagged an hour ago, and Braintree's database doesn't talk to Square's. Each processor maintains their own fraud scoring and risk assessment, meaning your card's "reputation" resets with every new payment ecosystem you enter. This isolation is your advantage - what burns you on one processor stays burned on that processor, while every other payment gateway sees a fresh, clean transaction history. This means you maximize the possible $$$ you can extract from any single card!

Obviously, this strategy only takes you so far before the bank itself starts paying attention. All these transactions are still hitting the same issuing bank, and they've got their own fraud monitoring watching for unusual spending patterns. But rotating processors buys you precious time and additional transactions before that bank-level scrutiny kicks in.

Building Your Processor Intelligence Network

Knowledge is power, and in this game, knowing which processor a merchant uses before you hit them is like knowing the answers to a test before you take it.

Build your intelligence:

- Check payment page source code

- Look for processor logos at checkout

- Test with dead cards to see error messages

- Document everything

Conclusion

Strategic carding isn't about being the fastest gun in the west. It's about being the smartest player at the table. While everyone else is burning through cards like they're lighting cigarettes with hundred-dollar bills, you're playing chess, thinking three moves ahead.

Remember: Every burned card is money you left on the table. Every flagged transaction is heat you brought on yourself. Every pattern you create is a breadcrumb leading back to your door.

Card smart. Rotate processors with each hit. Vary your patterns. Track your data. And for fuck's sake, stop treating cards like they're single-use condoms. With the right approach, that $20 card can generate thousands in value instead of dying after one measly transaction.

The game's evolved. The question is: have you?

Stay paranoid, stay profitable. d0ctrine out.

Last edited by a moderator: